Big Data and Analytics: Test Capital Markets Data Through Automation

- Somen Pal, Senior Architect (Delivery)

-

Jul 04, 20235 min read

In the capital market hedge fund industry, big data analytics has become an essential tool for analyzing and understanding market trends and patterns, making better investment decisions, and managing risk. One of the main advantages of big data analytics in the capital market hedge fund industry is the ability to analyze vast amounts of financial data in real-time. This allows hedge funds to identify trends and patterns that may not be visible through traditional analysis methods.

With access to a vast amount of financial data, hedge funds can gain deeper insights into market behavior and make more informed investment decisions, manage risk more effectively, and improve their overall performance. Also, when it comes to machine learning algorithms and predictive analytics, asset managers can create models that can automatically analyze market data and make investment decisions. This can help hedge funds to improve the speed and efficiency of their investment process and reduce the risk of human error.

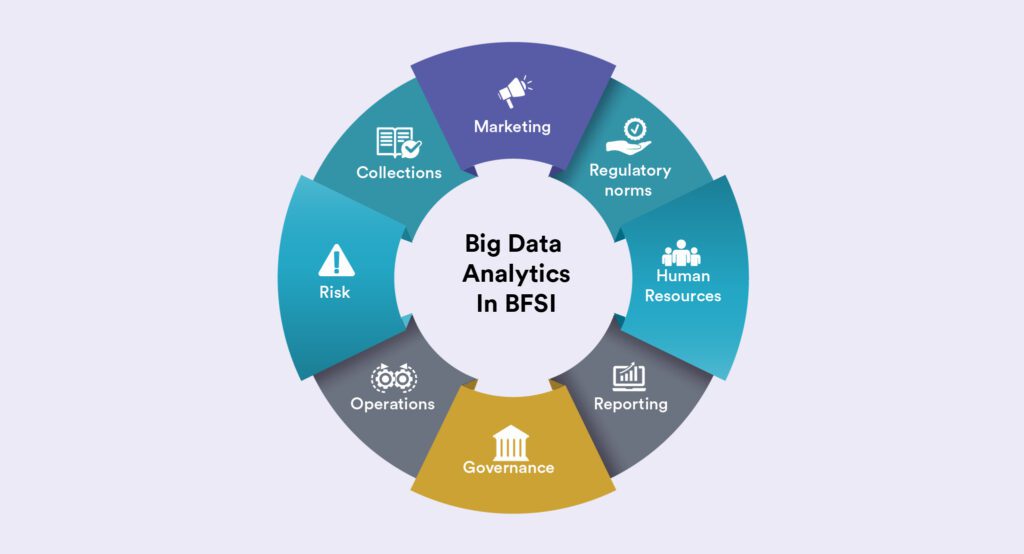

Big data analytics is becoming increasingly important for capital markets together with a large emphasis on regulatory reporting.

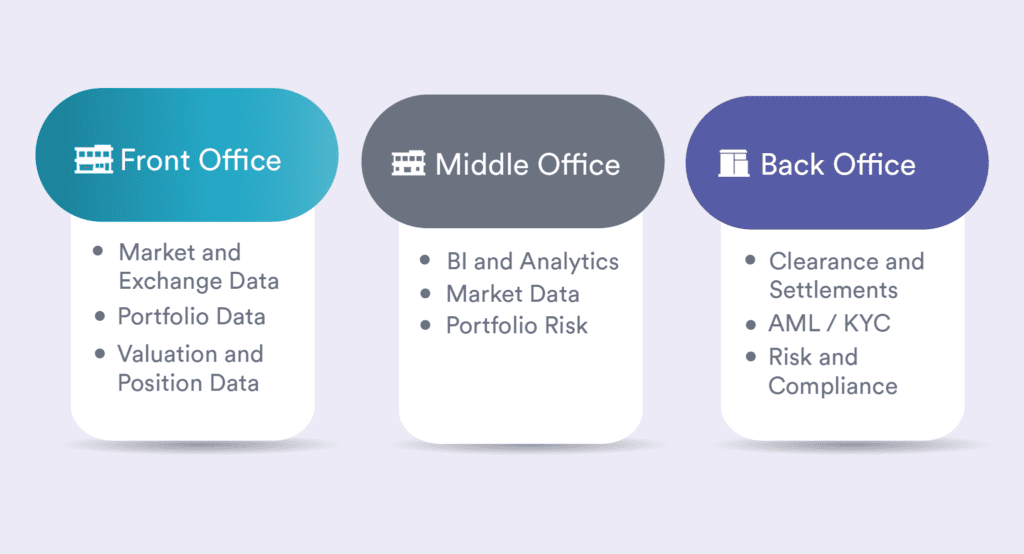

There are different types of data that traders use to make informed investment decisions. Here are some of the most common types of data in trading:

In addition, there are also several data providers feeding such data to firm’s data platform Some of the most popular platforms include:

Very similar to front office, data is also heart of almost all middle and back office applications.

With the ever-increasing volume of data being generated today, asset manager and institutional investors are exploring several tools and big data platform that provides portfolio management features, risk analytics, and trading capabilities.

Testing data at scale has become a critical challenge for organizations aiming to adopt advanced data analytics platforms. Traditional manual testing methods are time-consuming, error-prone, and not scalable. Advanced automation strategy offers solution to these challenges and enables organizations to test data at scale quickly, accurately, and efficiently.

Some of the use cases ideal for automation are:

There are also several challenges which include:

Quality engineering is an essential aspect of big data testing. It involves ensuring the accuracy, reliability, and efficiency of the data processing and analysis.

The quality of the data is crucial for accurate analysis. Quality engineering involves verifying the accuracy, completeness, and consistency of the data through:

Automated data testing offers several benefits for organizations, including:

The role of big data and analytics in test capital markets data is a crucial one, and through automation financial institutions can unlock the power of vast amounts of data, thus gaining valuable insights and improving their decision-making processes. The benefits of automated data testing can pay dividends and enhance risk management, optimize trading strategies, and help organizations achieve a competitive edge in the ever-evolving landscape of capital markets.

If organizations embracing automation and leverage big data analytics this will create a transformative opportunity for them as they seek to navigate the complexities of today’s financial world with agility and precision. With the right tools and a data-driven mindset, financial organizations can embark on a journey of innovation and continuous improvement, which will drive their growth and success.